Will China Tariff Deal Heat Up Quiet PE Deal Market?

President Trump’s April tariff announcement introduced new trade-related volatility into the U.S. private equity market and has brought deal activity in the middle market to a near halt. However, the announcement on May 12th of the framework for a trade deal with China, which temporarily slashed levies on each other’s goods, signals a significant shift in strategy by the Trump Administration that could lead to more stability in markets. Does this deal signal that better times are ahead? Will the U.S. deal market see a spike in deals in the near term?

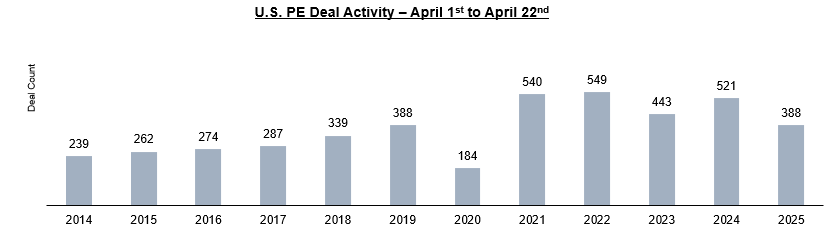

Following the April tariff announcement, rising input costs and renewed strains on the supply chain have been compressing deal volumes, extending diligence timelines, and accelerating the shift toward private credit as traditional debt markets remain constrained. The uncertainty sparked by the tariffs drove deal activity to levels last seen during the COVID pandemic and the financial crisis of 2008-09. According to Dealogic, M&A contracts, a key measure of economic health and business optimism, plunged to 2,330 in April, the lowest level since February 2005 and 34% below the historical monthly average for the past 15 years.[1] In the U.S., between April 1st and April 22nd, there were 388 PE-backed deals closed or announced. This is a ~25% drop from the same period last year and the lowest number of deals in April since 2020.[2]

Although service-oriented industries such as software and financial services are typically more insulated from direct tariff exposure, market uncertainty—and the indirect effects of tariffs on vertically focused technology and services—are already impacting deal flow in those verticals. Verticals with direct exposure, such as manufacturing sectors reliant on global suppliers and cross-border trade, are feeling the pressure even more acutely.

Industries reliant on imported raw materials and high-tech components (e.g., hardware manufacturing, semiconductor production, and consumer products) face sudden and significant cost pressures. Potential margin compression and supply chain disruptions resulting from tariffs could lead to lower earnings and valuations for companies in these sectors.[3]

Tariffs and heightened market volatility have also made exits more difficult for PE firms, leading to extended hold periods, constrained financing options, and increased pressure to deliver value through operational improvements. While dry powder levels remain high, sponsors have been navigating a more complex landscape as they weigh when and how to deploy capital amid shifting conditions.

Many PE firms entered the year anticipating a more favorable exit environment. Instead, prolonged market dislocation has delayed exits and pushed sponsors to focus more heavily on value creation.

Swedish investment firm EQT expects the tariffs to slow down its exit activity and will instead find ways to increase the value of its existing portfolio.

“EQT will focus fully on value creation rather than exits if the uncertainty is prolonged.”[4]

At the same time, access to financing has tightened. As of the date of posting, the U.S. high-yield bond market has largely frozen, and major lenders, including Citigroup, JPMorgan Chase, and Morgan Stanley, have scaled back their commitments to debt-funded deals. Sponsors are increasingly turning to private credit and nonbank lenders, often at higher borrowing costs. These financing constraints further pressure deal profitability and exit valuations, making sponsors more cautious about leverage in the current environment.[5]

Capital constraints also extend to fundraising. Many LPs have yet to see meaningful distributions from prior fund vintages, which limits their ability to commit to new funds. As one PE investor notes:

“Nearly half of all deals completed in 2019 have yet to return capital to LPs. This extended capital lockup strains the fundraising cycle and limits reinvestment opportunities, prompting many firms to explore alternatives such as NAV-based financing and expanded use of the secondary market.”[6]

A report in early April from the Financial Times found that market volatility is causing LPs to explore selling out of private market positions. Still, other industry sources indicate this is likely not the case. “[...] the reality is that most LPs are not likely to make such reactionary decisions to sell at steep discounts.”[7]

LOOKING FORWARD - WILL THE DEAL MARKET REBOUND IN THE NEAR TERM?

While much remains to be seen, some PE industry analysts are cautiously optimistic that, given the recent trade “deals” and shift in strategy, once investors fully adapt to this new trade policy landscape (and if the temporary measures like the 90-day pause influence long-term policy), overall PE deal flow in the U.S. in 2025 could surpass that of 2024. The deals with China and the U.K. present a notable shift in the Administration’s approach to tariffs and have provided some reassurance to U.S. markets. Although shortages of some goods from China will pressure the U.S. economy in the coming weeks, the announced agreement eases the risk of a prolonged recession in the U.S. However, the lack of clarity around future and ongoing trade negotiations continues to undermine the renewed optimism in the market.

Many of Bantry’s clients, although encouraged by the recent deals with China and the U.K., remain concerned that the volatility of U.S. markets will persist as the Trump Administration’s trade policies continue to evolve. In an informal survey of several Bantry Partners clients, the general consensus is that most PE funds do not expect U.S. deal activity to increase sharply in the near term. However, many believe that the tariff deals imply that better times are indeed ahead (or, at least, the risk of a deep recession has been somewhat mitigated).

As one PE managing director notes, “The China deal is a very positive sign that we could return to some normalcy in the markets. But it’s way too soon to tell. Will these deals hold? What exemptions will be added to deals, and how could that impact the verticals that we focus on? There is still considerable uncertainty in the market, and we don’t yet know where it is headed. But… this is a good sign that 2025 should not be a total loss and could become a pretty good year in the market when it is all said and done.”

WHAT CAN PE FIRMS DO?

Due to the heightened uncertainty in the market, PE firms need to ensure they are making well-informed investment decisions and implementing comprehensive due diligence processes. Market diligence is a key aspect and vital to understanding the impact of tariffs on a target (or portfolio company’s) business. At Bantry Partners, our team has completed hundreds of market diligence engagements across most sectors of the U.S. economy, and we have extensive experience in helping our private equity clients assess a wide variety of macroeconomic and geopolitical risks, dating back to the 2009 Financial Crisis and continuing through the COVID-19 pandemic. We can advise our clients on the changes that tariffs are causing in different industries for new and existing investments.

Many PE firms are extending hold times due to the challenging exit environment. During these extended hold periods, they must focus on creating value with portfolio companies. Bantry Partners is well-positioned to support private equity firms in these efforts through growth strategy, competitive analysis, and voice-of-customer engagements. As our PE clients seek ways to create value at existing portfolio companies and conduct thorough due diligence on potential new investments, at Bantry Partners, we are prepared to help you navigate this period of uncertainty.

CURRENT TARIFF STATUS AFTER “DEALS” WITH CHINA & U.K.

On May 12th, the Trump Administration announced that the U.S. and China have agreed to reduce their tariffs for 90 days. Although many of the final details have yet to be announced, the 90-day pause will begin on May 14th and reduce U.S. tariffs on Chinese imports from 145% to 30%.[8] The agreement with China came on the heels of a trade agreement with the U.K. that President Trump announced on May 8th. While the deal with the U.K. is also not yet finalized, it would lower tariffs and ease trade barriers, thereby expanding U.S. access to U.K. markets in agriculture and industry, while introducing quotas and tariff adjustments in sensitive sectors such as autos and steel.[9] The Trump administration reports to have struck deals with multiple other countries, but as of the date of posting, these negotiations have yet to be finalized and have done little to calm market uncertainty.[10]

| Country | Rate |

|---|---|

| China | 30% - All products during 90-day pause beginning on May 14th |

| Mexico |

0% - Imports compliant with the United States-Mexico-Canada Agreement (USMCA)* 25% - Imports not compliant with USMCA |

| Canada |

0% - Imports compliant with USMCA 10% - Energy and potash imports 25% - Imports not compliant with USMCA |

| European Union |

10% - Baseline tariff 20% - Originally proposed reciprocal tariff before April 9th's 90-day pause |

| United Kingdom |

10% - Baseline tariff Under Trump's proposed trade deal (that is not finalized), the U.K. would be exempt from the 25% tariff on steel and aluminum, and U.K. car tariffs would be lowered from 25% to 10% on the first 100,000 vehicles |

| Japan |

10% - Baseline tariff 24% - Originally proposed reciprocal tariff before April 9th's 90-day pause |

| South Korea |

10% - Baseline tariff 25% - Originally proposed reciprocal tariff before April 9th's 90-day pause |

| Rest of World | 10% - Baseline tariff on all imports during 90-day reciprocal tariff pause beginning on April 9th |

| All Countries | 25% - Steel and aluminum, car parts, and automobile imports |

*USMCA compliant imports are materials from North America, products wholly manufactured from originating materials in North America, products manufactured from materials outside North America that undergo “substantial transformation” in North America, and other products assembled in North America without substantial transformation that meet product-specific regional content/costs requirements (e.g., a vehicle must contain at least 75% regional content to qualify as originating, with additional workforce wage requirements.)[14]

CITATIONS:

[1] Dealogic

[2] Why some PE megadeals have defied the tariff-driven halt - PitchBook

[3] Trump Administration Tariffs: Key Considerations for Private Equity Investors | Mintz - JDSupra

[4] EQT expects slow exits amid tariff uncertainty - PitchBook

[5] Trump tariffs freeze US junk bond market, rattling Wall Street and private equity deals

[6] PE outlook: strategic opportunity amid Trump trade policy shifts | Delano News

[7] LPs slow their pace: ‘Nobody is getting fired for taking things slowly right now’

[8] US and China agree to slash tariffs as trade war eases

[9] UK-US tariff deal: Cars, steel and beef - what you need to know

[10] US trading partners raise doubts about just how far along tariff talks really are - POLITICO

[11] A timeline of Trump’s tariff actions so far | PBS News

[12] Tariffs: Analysis and investment implications | FS Investments

[13] Annex-I.pdf