Introducing The Bantry Partners Middle Market Activity Index

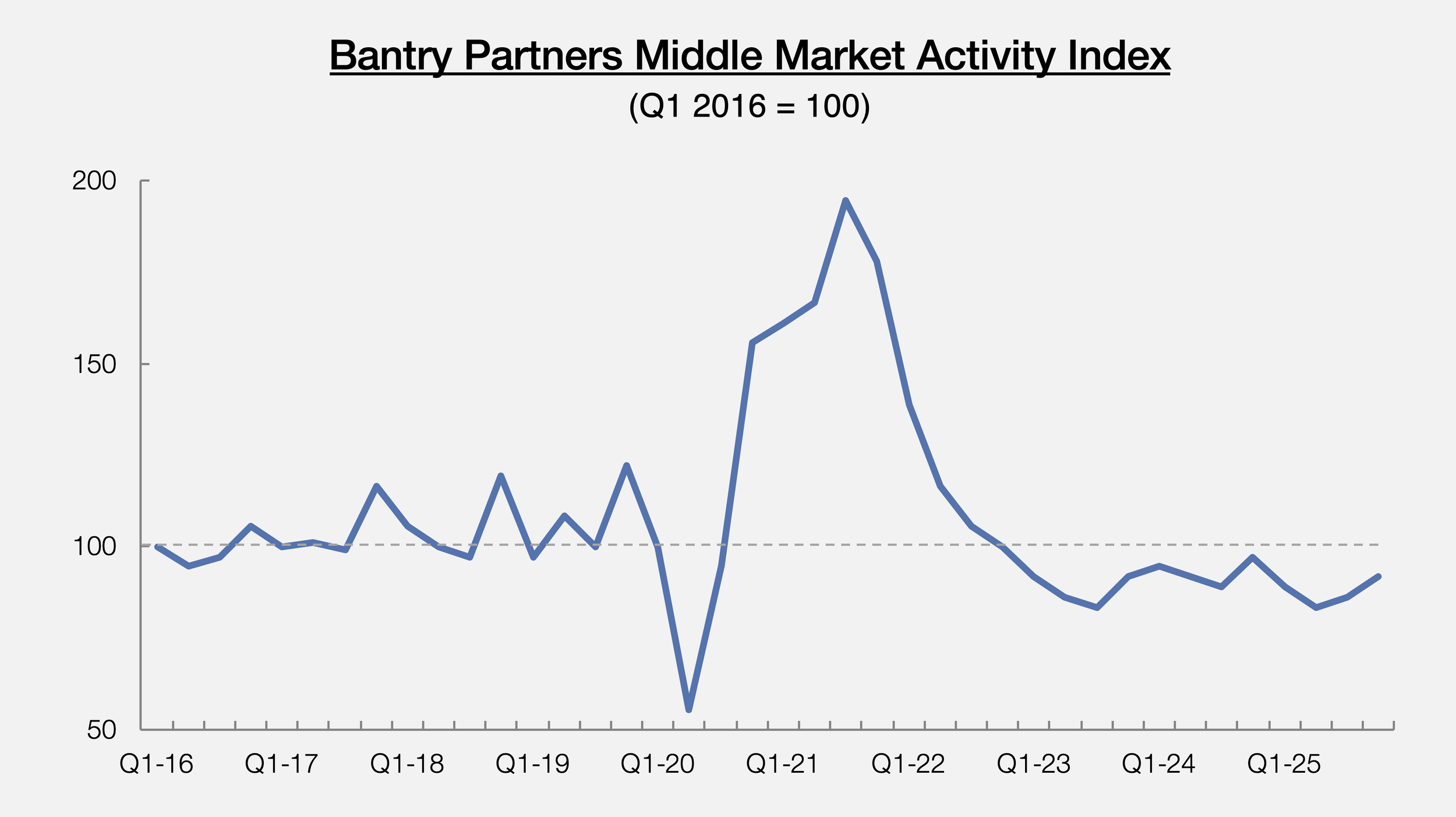

Bantry Partners is proud to introduce the release of our Middle Market Activity Index. The index reflects our view on the state of the Private Equity Middle Market based on more than a decade of deal data and market feedback from a wide range of deal professionals.

Tough Sledding For Many In 2025

2025 opened with a great deal of optimism in the middle market. Many deal professionals were hoping that years of pent-up deal demand, and the accompanying dry powder, when coupled with abating inflation, rate cuts late in 2024, and a more pro-business administration taking office, would drive a strong 2025 after an unprecedented three years of challenging market conditions (most prior declines in the middle market lasted only 1-2 years).

"We had a lot of optimism at the end of 2024. The cost of capital was finally turning the corner, making deals a little more affordable, and it sure seemed as if everyone expected the Trump Administration to turn up the heat on the economy. There was a sense that valuations, which have been so out of whack, and particularly in software, might abate as more deals came to market." Principal, Middle Market Private Equity Firm

The first quarter of 2025 saw a slight pickup in activity, though the number of bank-led processes remained relatively stagnant. But the optimism of the first quarter was quickly derailed by the onset of the Trump Administration's broad tariff policies, introduced on "Liberation Day" in early April. The ensuing uncertainty, stemming from the "back and forth" nature of the Administration's trade negotiations and tariff changes, led most deal professionals to pause their plans.

In addition, despite the 2024 rate cuts and heightened competition among lenders, the ongoing burden of high capital costs continued to limit activity across much of the middle market. In large part due to economic uncertainty / limited growth driven by tariff policies, the Federal Reserve put further expected rate cuts on hold.

"The deal environment never really got rolling (in 2025). It's hard to figure out what to do with a deal when the macro environment is so uncertain. Much of the work that we had done on a couple of prospective deals early in the year had to be started from scratch due to the implementation of tariffs. It made it an extremely difficult market to operate in, which has been the case really since 2022." Partner, Middle Market Private Equity Firm

About The Bantry Partners Activity Index

The Bantry Partners Activity Index leverages proprietary deal / activity data from the past decade. This data is corroborated by deal data from Pitchbook, PE Hub, Capstone Partners, and other sources. In addition, Bantry utilized feedback from more than 50 deal professionals across private equity buyout shops, portfolio company/corporate development and strategy, and investment banks.

As the year progressed, signs of increased market activity emerged. Tariff/trade policies stabilized somewhat, and three Fed rate cuts (three 25-bps cuts starting in September) drove some optimism across the market. However, there was no discernible evidence of deal teams driving to close a flurry of deals as the year closed.

"The market just couldn't get off the ground (in 2025). It wasn't a total disaster, but every time we thought there could be a flurry of activity, something seemed to happen to derail it." Partner, Investment Bank with Technology Focus

"Good Deals" Saw Increased Competition

Many deals completed in 2025 were for companies viewed as true market leaders with strong valuations. Competition for these "strong" deals was exceptionally high in 2025. Deals perceived to have strong fundamentals or to be in attractive market segments attracted strong competition. In contrast, "average" companies typically faced headwinds to close.

"Sometimes, hundreds of funds would look at a stronger deal. I know of funds that were getting very discouraged. There just wasn't enough good deals out there, and the economic conditions made it hard for deal teams to take risks or reach for what would have been viewed as a good opportunity when times were better." Director, Middle Market Investment Bank

Despite these challenges, Pitchbook reports that platform deals increased slightly across the middle market. However, add-ons only increased modestly, and exits continued to decline in 2025.

Aerospace / Defense & Construction / Industrial Services Outpaced Other Sectors

Despite the market challenges, some sectors saw increased deal activity. Activity in the aerospace / defense sector increased as rising geopolitical tensions drove global demand for aerospace / defense spending.

Construction/industrial services also saw some investment growth in 2025. HVAC services stood out as a particularly strong market segment. Continued investment in housing starts to address affordability, and the Trump Administration's goal of driving increased domestic industrialization, drove increased deal activity.

Although the uncertainty of the Trump Administration's healthcare policies made for a challenging environment in 2025, some specific healthcare segments did well. The aging U.S. population, rising incidence rates for some conditions (e.g., mental health, cancer, etc.), and the ongoing shift to value-based care drove some increases in specific segments such as behavioral healthcare services and some specialized services utilizing digital health & AI.

Deal activity in the technology / software sector continued to stagnate with high valuations and limited exits in 2026. However, there were some pockets of activity, including AI-related infrastructure (data centers and infrastructure, industrial automation, etc.) and Insurtech.

Increasing Activity – But "No Spike in Deals" Expected In Q1-26

Pressure from limited partners (LPs) continues to mount to deploy ~$1.6 trillion in dry powder (according to Capstone Partners), and pent-up demand for exits is at unparalleled levels. When coupled with the end of year rate cuts and less tariff instability, many deal professionals reported increased activity as 2025 drew to a close. Several deal professionals at investment banks reported working on a large increase in possible deals. Some even report having to turn away pitch opportunities due to the increasing activity, including in segments with prolonged declines in deal activity, such as software and some business services.

Will this lead to a fast start to 2026? It's certainly a positive development. However, although most deal professionals are optimistic about the coming year, few expect to see a dramatic increase in activity in the first quarter.

Rather, most deal professionals anticipate more of a gradual increase. Although the Administration tariff policies appear to have somewhat stabilized, and future rate cuts are on the table, the macroeconomic environment is viewed by what one deal professional summarizes as "more stable but still fraught with risk that it can become chaotic at a moment's notice."

"There have been years in the past where we start off like gangbusters. I know there are a lot of pitches being prepped in the market, but we'll see how they all are timed. I'm just not expecting a big increase because 2025 is behind us, and it's now 2026. There are still so many uncertainties in the market." Principal, Middle Market PE Fund

Given the backdrop of the market's struggles since 2022 and the uncertainty in the macroeconomic environment, most deal professionals do not anticipate a strong start to 2026. Rather, most expect deal activity to increase moderately from Q4-25. The momentum for the rest of 2026 is likely dependent on the stability of the macroeconomic environment and continued Federal Reserve rate cuts.

Cautious Optimism for 2026

Prior downturns in the middle market, the 2009 financial crisis, and the 2022 COVID pandemic shutdown were followed by sharp recoveries that led to sustained higher levels of deal activity. However, despite the length of the current challenges to the middle market deal environment, no sharp increases in deal activity are expected in 2026.

However, most deal professionals expect to see steady improvement in 2026 with financing conditions easing and exit activity resuming growth.

"We're optimistic about 2026, but I don't think it'll be the year that sees a huge bounce back in deal volumes as we saw after COVID. Being more realistic, I think we'll see improving conditions and see deal flow look better than it has since 2022. But, it can be derailed pretty easily." Partner, Middle Market Private Equity Firm

Deal activity is expected to gain momentum in several sectors:

Industrial / construction services are expected to see growth in 2026. Many deal professionals expect continued consolidation of HVAC services, roofing providers, and other services.

Insurance-related deals are expected to increase for insurance services, distribution, and Insurtech, driven in part by increased use of AI / digital transformation and easing of the regulatory environment.

Healthcare should remain relatively stable, but Bantry expects some specific markets to see continued growth, including behavioral health services, Med spas, and dentistry (where practice roll-ups continue to proliferate).

Could 2026 be the year that the Software / Technology sector accelerates? Data centers and other AI-infrastructure plays are expected to drive some growth, but there is some evidence that seller expectations for multiples are more in line with market expectations after years of stymied deal activity.

There are some notes of caution in other sectors:

The domestic manufacturing resurgence that was hoped to be driven by tariffs has yet to materialize. Manufacturing employment fell by 0.6%, and the contraction in U.S. manufacturing output continued for the 3rd straight year in 2025. When coupled with continued uncertainty around tariffs and supply chains, and rising input costs on imported components (due to tariffs), it is unlikely that the sector will strengthen substantively this year.

The automotive sector continues to experience margin pressure due to many of the same challenges facing the broader U.S. manufacturing base (tariffs, rising input costs, etc.). This is exacerbated by higher financing costs for consumers and evolving powertrain expectations (away from all-electric to either legacy internal combustion or hybrid vehicles). Despite these challenges, deal activity could post a moderate increase as manufacturers and suppliers seek increased vertical integration and a strategic approach to electrification and digital platforms.

The middle market is ripe for a rebound. But, will it happen in 2026, and will it be a marked increase in deal activity? Most middle market deal professionals, given recent trends in deal activity and the challenges in the market going back to 2022, are cautiously optimistic.

As stated previously, many deal professionals expect to see some improvement in the first quarter of 2026, but do not anticipate a marked increase in deal flow. Looking forward to the rest of the year, most see the possibility of an accelerating rebound in the middle market, and particularly if pressure from the Trump Administration leads to continued rate cuts. However, many also view the geopolitical risks, ongoing trade disputes / tariffs, and the demand for deals that continues to drive valuations, driving only moderate gains in 2026.